How does an Employee Stock Options Plan (ESOP) work?

Business Development

303 week ago — 6 min read

Background: An Employee Stock Options Plan (ESOP) is an employee benefit plan that allows the employees of an organisation an ownership interest, many a times with upfront cost. ESOPs basically allow employees to purchase stocks of a company at a price which is lower than the market price. They are set up as trust funds and can be funded by the company by depositing newly issued shares in them, putting in cash to buy existing company shares, or borrowing money through the entity to buy company shares. ESOPS are usually a part of an employee’s remuneration package. This way the sponsoring company, the shareholder and the employees, all receive various tax benefits. Co-founder of Lexstart, Anisha Patnaik, explains how ESOPs work.

In our experience of having assisted several entrepreneurs with execution of ESOPs for their startups, we have observed that most entrepreneurs are under the impression that by just mentioning the number of ESOPs on their cap table, or in offer letters to their employees, the startup has fulfilled its obligation to grant ESOPs to its employees. This is actually incorrect.

Mentioning ESOP pool on your cap table actually just makes your investors happy. Why?

Well when an investor invests in your startup, they want to ensure that they do not get diluted for any reason except in case of future rounds of fundraising by your startup (even for that they have the right to maintain valuation aka pre-emptive right). It is important for investors that their shareholding does not get diluted in order to give shares to your employees, mentors or all those well-wishers of yours, whose help and guidance you took in the initial days of starting up and promised equity to. Only you the founder should get diluted to give these promised equity shares to your mentors and advisors, not the investors. This is the reason why investors require a startup to create an ESOP pool/advisory stock option pool, as a condition precedent to their investment in a startup. This is also the reason why investors require you to convert all loans from friends and family, and conversion of convertible notes, if any.

Most entrepreneurs are under the impression that by just mentioning the number of ESOPs on their cap table, or in offer letters to their employees, the startup has fulfilled its obligation to grant ESOPs to its employees. This is actually incorrect.

Therefore, all you have achieved by mentioning a ‘ESOP Pool’ on your cap table and inserting a number against it is (a) carving out the maximum number / percentage up to which your investors won’t get diluted, and (b) demonstrating to your investors, your intention to give ESOPs someday to your employees.

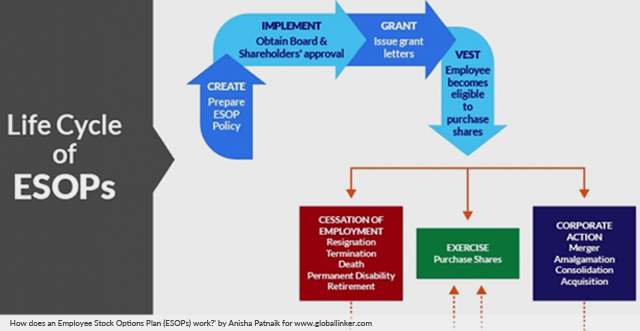

At this stage, where your startup’s ESOPs are only on the cap table, your ESOPs are only a virtual pool. How do you convert the ESOPs in to reality? Well, that’s easy; you will just have to create an actual ESOP pool. In order to do that, you will have to take the following steps:

Step 1

Draft an ESOP Policy in compliance with the Indian Companies Act, 2013. The ESOP Policy will have to set out in detail the terms of ESOPs, cliff period, vesting schedule, exercise price/strike price, exercise period, consequences of employee leaving the startup, consequences of the startup getting acquired, etc.

Step 2

Once the draft ESOP policy has been finalised and if you have investors in your startup, then check your Shareholders’ Agreement and Articles of Association, to verify if the approval of investors for an ESOP policy will be required. Lost? Well, just look for a clause that is titled either as ‘reserved matter right’ or ‘affirmative voting matter’ or ‘affirmative voting right’ or ‘investor protection matter’.

Once you find this clause, then look through the several items and check if creating a stock option, ESOP etc. is listed therein. If it is, then you would have to send an email to your investor along with copy of the ESOP policy for your startup, requesting the investor for its approval to the ESOP policy.

Pro tip: Most VCs get their respective legal team to also review the ESOP policy. Therefore, be prepared for few iterations and discussions.

Step 3

Where you don’t have any investors in your startup, you can skip step 2 and directly proceed with step 3, i.e., convene a board meeting for approval of the ESOP Policy. How to convene a board meeting properly under Companies Act, 2013?

Step 4

Convene a meeting of shareholders (aka EGM) of your startup, for approval of the ESOP Policy. Now that you have an ESOP policy and can formally start granting ESOPs.

Stay tuned for more articles on ESOPs.

Interested in reading more articles on GlobalLinker? Check out some of our other articles here:

Online Udyog Aadhaar registration process

Trademark your brand to safeguard your brand

Mandatory compliances for a Private Limited Company in India

Image courtesy: shutterstock.com

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

View Anisha 's profile

Other articles written by Anisha Patnaik

The valuation game: What does it mean?

301 week ago

Can you grant ESOP to a co-founder?

302 week ago

Most read this week

Trending

Ecommerce 1 week ago

Comments

Share this content

Please login or Register to join the discussion