Have you linked your Aadhaar to PAN yet?

Legal & Compliance

402 week ago — 2 min read

The government has made it mandatory to link your Aadhar number with PAN for filing taxes from July 1 onwards. As per a Supreme Court judgement on Aadhaar-PAN linkage, it has been stated, “Everyone who has been allotted permanent account number as on the 1st day of July, 2017, and who has Aadhaar number or is eligible to obtain Aadhaar number, shall intimate his Aadhaar number to income tax authorities for the purpose of linking PAN with Aadhaar.”

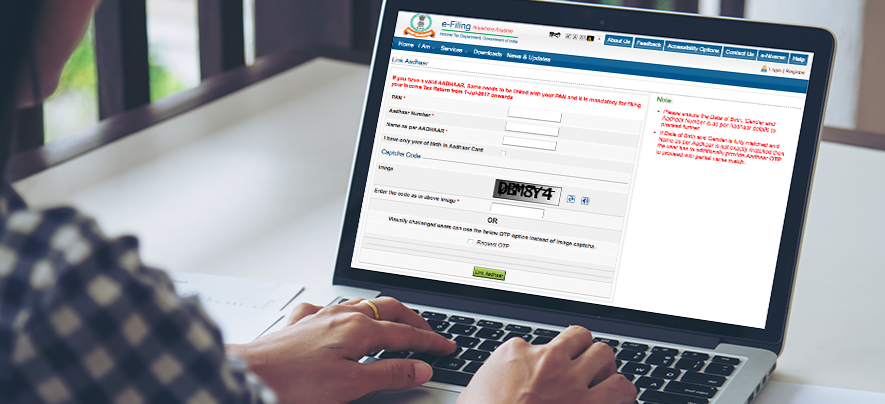

Here’s the two-step process to link Aadhaar with PAN:

Step 1: Visit the government of India income tax e-filing portal and click on ‘Link Aadhaar’

Step 2: Provide the details of your PAN, Aadhaar number and enter name exactly as given in the Aadhar Card. Ensure that there are no spelling mistakes. The linking will be confirmed once the details you provide ate verified by UIDAI (the government website for Aadhar).

In case of any minor mismatch in Aadhaar name provided, Aadhaar OTP will be required. Please ensure that the date of birth and gender in PAN and Aadhaar are exactly same.

In a rare case where Aadhaar name is completely different from name in PAN, then the linking will fail and taxpayer will be prompted to change the name in either Aadhaar or in PAN database.

For those registered on the income tax website, the process of linking Aadhaar with PAN is also available after login. Once you log onto the e-filing portal, the 'Link Aadhaar' option is available under 'Profile Settings'.

While Aadhaar-PAN linking will be mandatory for filing income tax returns, it will also be required for obtaining a new PAN.

Image source: Freepik

Posted by

GlobalLinker StaffWe are a team of experienced industry professionals committed to sharing our knowledge and skills with small & medium enterprises.

Network with SMEs mentioned in this article

View GlobalLinker 's profile

Most read this week

Trending

Ecommerce 7 days ago

Comments (1)

Share this content

Please login or Register to join the discussion